Could the Latest Undersea Cable Surge Level Off?

Another issue raised by the new structure of the Internet is whether undersea cable capacity and other cross-border links will remain in high demand. This has become unclear in markets and on routes where a tapering off of demand for international capacity has already started to appear.

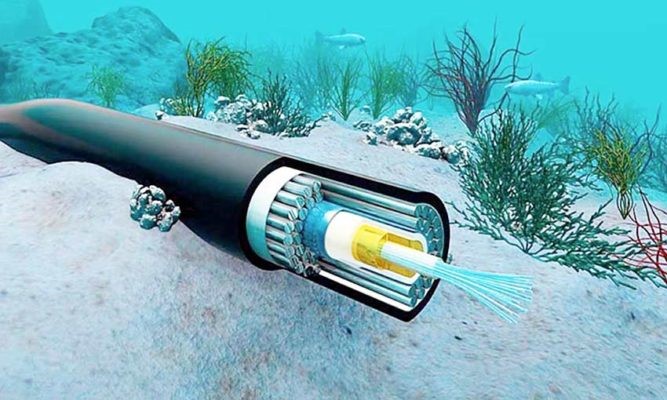

At the same time new capacity is being “lit” and both existing and new players are planning ever higher-capacity links on the world’s major routes as well as various secondary ones (Southern Hemisphere, East and West Coasts of Africa, etc.). Some of the new cables—at $300 million or more per project—are associated with heavy users such as Facebook or Microsoft. Other multi-terabit per second cables are being launched or planned by consortia and private investors with less direct connections to sources of demand. They simply assume long-route demand will continue to skyrocket.

Yet the trend lines may be in conflict. One trend is driven by the growing number of Internet users, devices, apps and content, calling for higher IP transmission rates at carrier levels. The second trend is content localization and caching, driven by the huge waves of IP traffic that the first trend creates, as growing usage continues to outpace declining transmission prices. Accordingly, more of the heavily used content (video, audio, social media, search) is being stored near end users, cutting the need for long route and even regional cross-border links. Looking ahead ten years or so, the need to send Internet queries “back to Rome” will likely lag the growth in users and content delivery speeds.

Cisco shows total IP traffic growing at a compound rate of 24% over the 2016-2021 period. This would normally call for three times as much international capacity in 2021 as was needed in 2016. However, 70% of the new traffic is projected to arrive at the user’s doorstep over CDNs, which would effectively drop the compound growth rate below 10%. Suddenly, the increased demand in 2021 vs. 2016 is only about 1.5X rather than 3X. This in turn raises the question of how much the new undersea and cross-border capacity being planned and deployed will be viable.

Chances are that too much capacity will be added over the next few years, given that much of the currently deployed undersea capacity is not fully lit and that the fully lit capacity is far from fully leased by carriers and large users. Plus the leased capacity offers wiggle room in that typically peak use is about six times average use, leaving excess capacity on which non-live traffic can be sent. Overall, we may soon face excess international capacity, mirroring what was experienced in 2000 at domestic levels across Europe and the United States.

Of course, the costs of international transit over undersea cables represent only one segment in the full range of end-to-end costs of providing CDN, cloud storage and other data services. The deceleration in demand will not be uniform. Regions with decelerating IP growth (barring an IoT explosion) and accelerating CDN capacity—think Western Europe and North America—could be hit the hardest. In other places regional and local demand will grow faster than long-route demand. Finally, in developing areas, overall data consumption per user will be increasing, even as the language and other constraints keep it from reaching the level projected by Internet optimists. This will generate a mix of long-route and regional demand depending on where the market stands in CDN-ization terms.