Should Netflix Opt Out of India’s Language Multiplex?

After Apple’s Tim Cook visited India and declared it “the next China”, we displayed skepticism in a blog more than two years ago on “Apples in India?” Since then Apple has been sidelined by competition from lower-priced Chinese, Indian and Korean competitors, leaving it with less than a 2% share of India’s smartphone market.

Netflix’s Reed Hastings was the next FAANG CEO to declare India its new miracle market. Speaking in New Delhi at a conference on “the Future of Entertainment” in early 2018, he said: "Given the consumer base, the next 100 million [subscribers] for us is coming from India." Hastings added that the country is “the most phenomenal example anywhere in the world of low Internet costs, expansion of 4G. We didn’t see that coming and we just got lucky on that one."

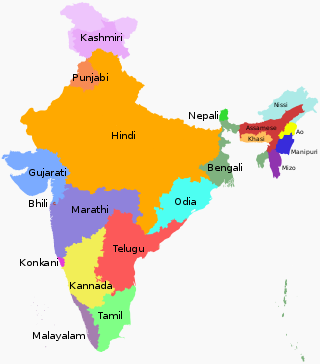

Map of India’s Official State Languages

It’s not hard to get excited about India when you read the macro projections. Cisco, for example, projects 828 million Internet users in 2020, up from 373 million in 2016. Unfortunately, India is a lot of micro markets—linguistic and otherwise (see map)—not one big macro one. And except for the very rich and the educated young, most of the segments are not keeping up digitally unless they are offered free—or close to free—services. It was, after all, free pricing that drove Jio’s dramatic entry into the mobile market in late 2016, drawing 50 million subscribers in 90 days while undermining the viability of other operators.

Even with Jio’s continuing surge, the number of Internet users in India in 2020 could fall short of Cisco’s estimate. Moreover, these will represent very few new households (Netflix’ principal target), as there are only 250 million households in India overall. (China, with its smaller-size families, has almost twice as many.) The slow Internet access speeds that prevail in India is another constraint as is the fact that many households do not own a TV set and even fewer have a smartphone available. Overall, it comes down to three main drivers—low prices, many languages, and …cricket, none of which Netflix has been able to offer.

Netflix charges Rs 450 ($6.30) per month for it lowest option, while Amazon Prime charges Rs 999 per year ($14.00). Local streaming services, including Hotstar, SonyLiv and Voot, generally come free and often include sports. Hotstar carries cricket, India’s national sport; SonyLiv carries football (i.e. soccer). Plus these services offer local content—in many of India’s official languages (see map above). Even Amazon Prime offers show in Hindi, Tamil and Bengali, while Netflix has so far been limited to English, a language that according to a recent blog from India “only about 12% of India’s population is familiar with.” Not surprisingly, Netflix’s share of the streaming market is under 2%, well below Amazon’s and orders of magnitude behind Hotstar’s.

Netflix is beginning to recognize its Grand Canyon-size language gap in India, and is promising local content soon. It also promises to try different prices and has already joined with Airtel to offer special promotions. Yet its content investment, if serious, will impact its debt. At some point Netflix may realize it would be better off concentrating on more cohesive language markets. Original content for the Thai, Malay, Vietnamese or Korean markets would likely have a higher payoff and not need to be discounted as much.

All this is not to deny India’s digital destiny. Aadhar, its digital ID system, now encompasses 1.1 billion people, a number achieved within a decade. This is a record-setting achievement, even compared to Facebook’s reaching the billion user level in 8 or 9 years as Aadhar has involved a single country. Also Aadhar is free, can be obtained at 27,000 banks and post offices, and uses the dominant language of each of India’s states. If you register in Mumbai you receive your card in Marathi, in Chennai it’s in Tamil, and so on. And you can change the language if you prefer a different one. English is one of the many options.

View Printer Friendly Version

View Printer Friendly Version